Mastering Accounting for Small Business Owners

Starting and running a small business is an exhilarating journey filled with challenges and rewards. However, one of the most significant aspects that can determine the success or failure of a business is its accounting practices. For small business owners, mastering accounting is crucial for tracking financial health, making strategic decisions, and ensuring compliance with tax laws.

The Importance of Accounting for Small Businesses

Many small business owners might overlook the importance of accounting. However, good accounting provides the foundation upon which successful businesses are built. Here are several reasons why accounting is crucial:

- Financial Clarity: Regular accounting helps businesses understand their financial position, including profits, losses, and cash flow.

- Informed Decision Making: Accurate records allow owners to make data-driven decisions, enhancing operational efficiency.

- Tax Compliance: Proper accounting ensures that businesses can accurately file taxes and avoid penalties.

- Attracting Investors: Transparent financial statements are necessary for attracting potential investors.

- Business Growth: With a clear understanding of the financial situation, owners can develop strategies for growth.

Understanding Basic Accounting Principles

Before diving into the practicalities of accounting for small business owners, it’s essential to understand some basic accounting principles. These principles form the backbone of sound accounting practices and help in maintaining orderly financial records.

1. The Accounting Equation

The basic accounting equation is:

Assets = Liabilities + Equity

This equation illustrates that everything a business owns (assets) is financed either through debt (liabilities) or the owner's investment (equity).

2. Double-Entry System

In the double-entry bookkeeping system, every transaction affects at least two accounts. This system helps maintain balance in the accounting records, significantly reducing errors.

3. GAAP Compliance

Businesses must adhere to Generally Accepted Accounting Principles (GAAP). GAAP provides a standard framework of guidelines for financial accounting.

Critical Accounting Tasks for Small Business Owners

Now that we understand the importance of accounting, it’s time to explore the critical tasks that small business owners need to manage effectively.

1. Bookkeeping

Bookkeeping is the process of recording daily transactions, managing invoices, and maintaining ledgers. It’s essential for tracking expenses and income.

2. Financial Reporting

Small businesses should generate regular financial reports such as income statements, balance sheets, and cash flow statements. These reports provide insight into the business's financial health.

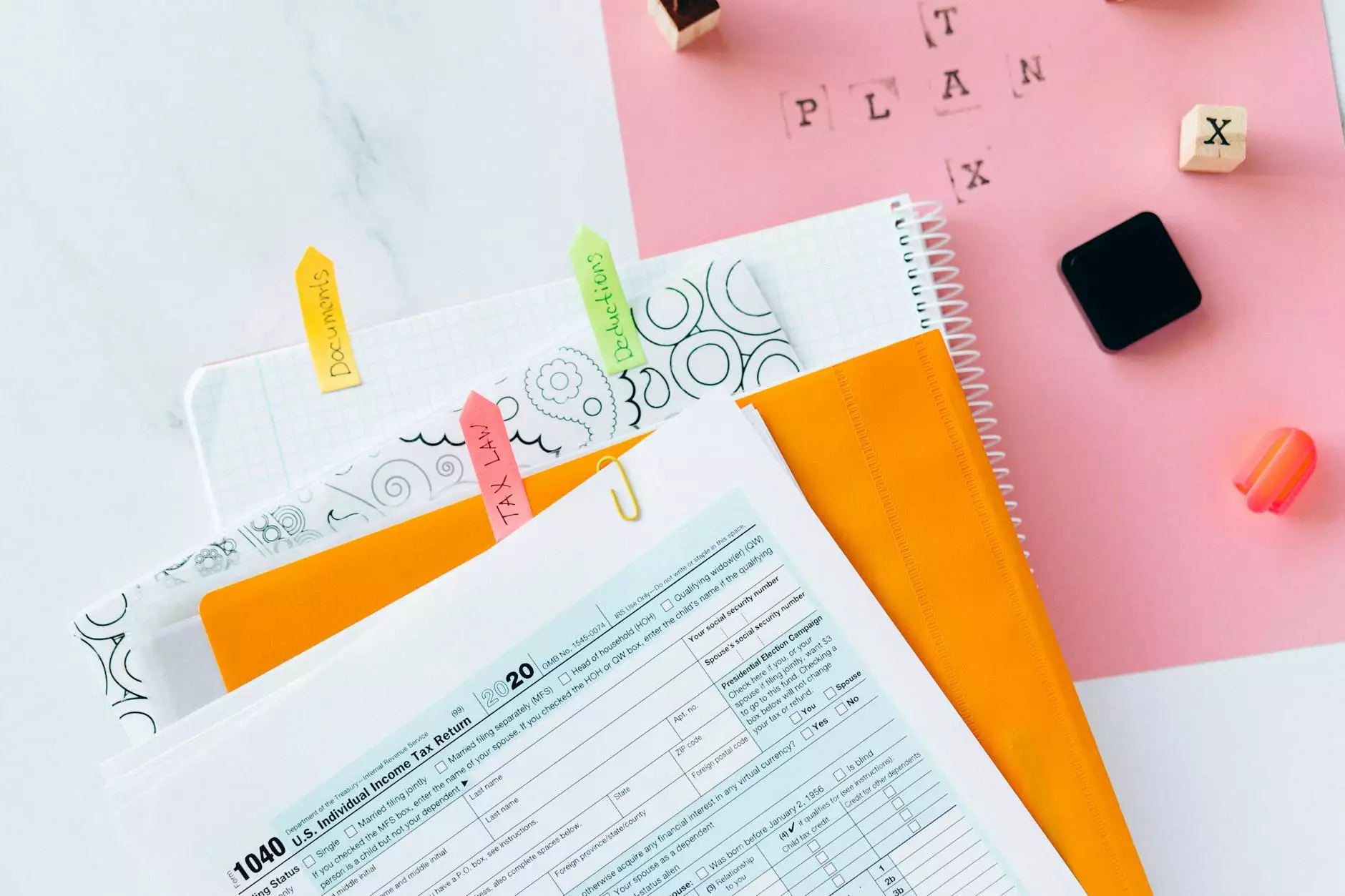

3. Tax Preparation and Compliance

Tax season can be particularly daunting. Small business owners must be diligent in preparing taxes by maintaining records of all transactions, utilizing tax-deductible expenses, and ensuring timely submissions.

4. Budgeting

Creating a budget allows small businesses to plan financial futures and set spending limits. This strategic approach ensures that resources are allocated efficiently.

5. Managing Cash Flow

Cash flow management is vital for small businesses to avoid liquidity issues. Keeping track of when money comes in and goes out ensures that the business can meet its obligations.

6. Payroll Management

Accurate payroll processing is essential for maintaining employee satisfaction and compliance with labor laws. Small business owners must ensure that wages are calculated and paid correctly.

Utilizing Accounting Software

In today's digital age, small business owners can greatly benefit from accounting software. Such tools streamline various accounting tasks, from invoicing to budgeting and reporting.

Benefits of Using Accounting Software

- Efficiency: Automates routine tasks, saving time.

- Accuracy: Reduces the chance for human error.

- Ease of Data Analysis: Provides insights through reports and analytics.

- Accessibility: Cloud solutions allow access from anywhere.

Popular Accounting Software Options

Here are some popular accounting software options ideal for small business owners:

- QuickBooks: A widely used accounting tool that offers comprehensive features.

- FreshBooks: Known for its user-friendly interface, particularly effective for freelancers and small teams.

- Xero: A cloud-based option that allows collaboration with accountants and easy invoicing.

- Wave: A free option tailored for small businesses with essential features.

Common Accounting Mistakes to Avoid

Even with the best intentions, small business owners can make common accounting mistakes that can lead to significant consequences. Here are some pitfalls to avoid:

1. Mixing Personal and Business Finances

This can create confusion in your records and complicate tax filings. It’s essential to maintain separate bank accounts for personal and business transactions.

2. Neglecting to Keep Receipts

Keeping meticulous records of receipts helps substantiate expenses during tax time and protects against audits.

3. Overlooking Regular Review of Financial Statements

Regularly reviewing financial statements is vital for staying informed about the business's financial health and making necessary adjustments.

4. Ignoring Cash Flow Management

Many small businesses fail due to cash flow issues. Closely monitor inflows and outflows to maintain financial stability.

5. Waiting Until Tax Season to Organize Finances

This can lead to overwhelming stress. Instead, incorporate accounting into your monthly routine.

Best Practices for Small Business Accounting

To ensure proper accounting practices, consider implementing the following best practices:

1. Establish an Accounting System of Record

Choose a method that suits your business needs, whether cash-based or accrual accounting.

2. Regular Reconciliation of Accounts

Reconciling your accounts regularly helps identify discrepancies and errors promptly.

3. Use Professional Accounting Help When Necessary

Consider hiring a professional accountant if your financial situation becomes overwhelming.

4. Educate Yourself Continuously

Staying updated with accounting changes and tax laws can be beneficial for your business.

Conclusion

In conclusion, accounting for small business owners is not simply a chore; it is an essential element for thriving and achieving long-term success. By understanding basic accounting principles, utilizing technology, and avoiding common pitfalls, small business owners can maintain a solid financial foundation. With diligent accounting practices in place, small business owners can focus on what they do best—growing their businesses and serving their customers.

Mastering your business's finances will ultimately empower you to make informed decisions, comply with regulations, and strategically plan for the future. Start today, and see how effective accounting can lead to a prosperous tomorrow.